CEIR Q3 2024 Index Reflects Continued Recovery, Growth of U.S. B2B Exhibitions

The U.S. B2B exhibition industry is gaining momentum after a minor slowdown in Q2 2024, according to the Center for Exhibition Industry Research (CEIR)’s Q3 Total Index report, which evaluates industry performance across four key metrics: attendance, net square footage, exhibitors, and real revenues.

Released on December 4, the report highlights mixed results, with increases in exhibition net square footage and recovering exhibitor participation contrasting with lagging revenues and attendance amid a favorable economic outlook hindered by high prices and political uncertainty.

Key Metrics Overview

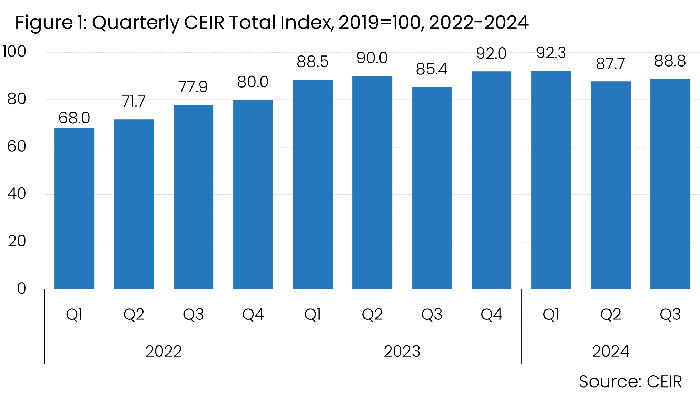

After hitting a post-pandemic high of 92.3 in Q1 2024, the Index value fell to 87.7 in Q2 but rebounded slightly to 88.8 in Q3, driven by improved net square feet (NSF) and exhibitor participation.

The Q3 2024 Total Index is 11.2% lower than the same period in 2019, an improvement from the 14.6% dip in Q3 2023. Compared to Q3 2023, the Index gained 3.4 percentage points and increased by 1.1 points from Q2 2024.

Among sampled events in the Index, 33.8% exceeded their pre-pandemic performance—a significant rise from 25.9% in Q3 2023. The cancellation rate for in-person events remained low at just 0.3%, down from 1.6% in Q3 2023.

“The data show a picture of continued rebuilding for the exhibition industry,” said Adam Sacks, president of Tourism Economics, a subsidiary of UK-based independent global advisory firm Oxford Economics. “These events remain vital to successful business operations and our forecasts for corporate performance support an outlook of further growth in 2025.”

Performance Breakdown

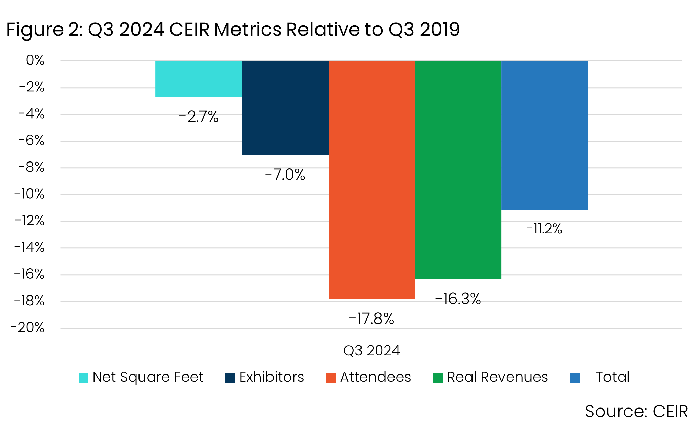

In terms of the four Total Index components, the Net Square Feet (NSF) metric shows the most recovery, currently just 2.7% below pre-pandemic levels from 2019. The Exhibitors metric is down by 7.0% below Q3 2019, while Real Revenues, adjusting for inflation, are lagging with a 16.3% shortfall compared to 2019. Showing the slowest recovery, Attendance numbers are down 17.8% (see Figure 2).

Despite lower unemployment and declining interest rates boosting consumer outlook, high prices are still a concern and could impact trade show attendance; for instance, the University of Michigan’s consumer sentiment index fell from 70.1 to 68.9 in October. Comparing the results to events held in Q3 2023, the report cites a similar pattern, with NSF maintaining relative strength and attendance lagging behind.

Economic Context

The latest CEIR Index results align with positive trends in the U.S. economy, where annualized GDP grew by 2.8% in Q3, fueled by strong consumer spending. The labor market remains resilient, with slowing inflation supporting real disposable income growth.

The Personal Consumption Expenditures (PCE) deflator rose 2.3% year-over-year in Q3, nearing the Federal Reserve’s target of 2%, while real disposable income increased by 1.6% at an annualized rate in Q3.

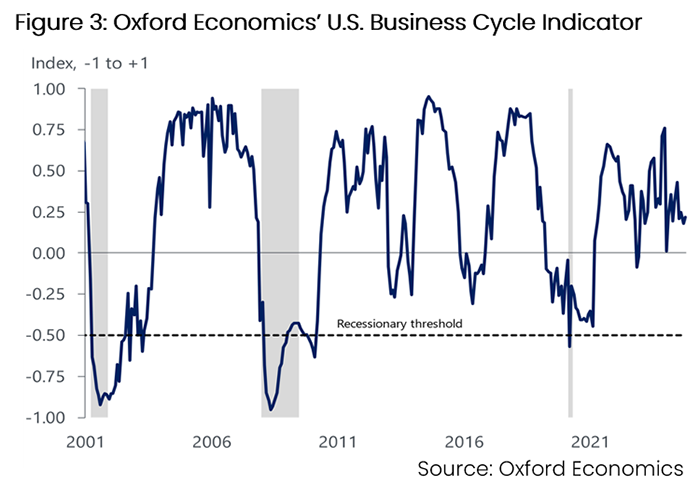

Tracking growth in key economic indicators, Oxford Economics’ business cycle indicator (BCI) saw a slight uptick from already high levels at the start of Q3 (see Figure 3). Despite challenges like hurricane impacts and a Boeing strike affecting job gains, the unemployment rate remains at 4.1%, with layoffs remaining low.

Manufacturing is currently one of the weaker areas of the economy, with industrial production declining year-over-year due to external factors but expected to improve sustainably in 2025 as lower interest rates encourage business investment. Ongoing trends like artificial intelligence advancements, the CHIPS Act, and the Inflation Reduction Act (IRA) will continue to support growth, and the fading effects of previous commercial and industrial lending tightening, along with rising electricity demand, are positive signs for this sector.

While the economic outlook remains positive, high interest rates present a downside risk. Recent inflation reports have been stickier than expected, and strong employment figures are shifting the balance of risks for monetary policy. According to Federal Reserve Chair Jerome Powell, “[t]he economy is not sending any signals that we need to be in a hurry to lower rates.”

Although CEIR projects a 25 basis point cut in December and three more cuts in 2025, there is a risk that the Fed may implement fewer reductions.

Looking Ahead to 2025

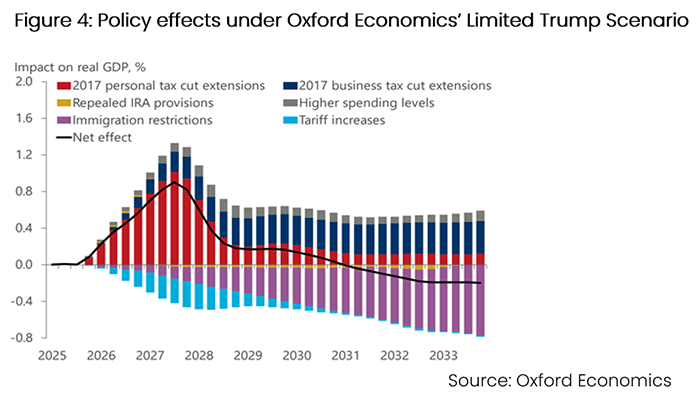

The U.S. economy is projected to outperform other advanced economies next year due to labor growth and strong investment despite anticipated higher tariffs that may not significantly impact until late 2025 or into 2026. Lower immigration (see Figure 4) will also affect the labor market over time as new immigrants become more integrated into it, and those who arrived in the last two years will continue to contribute to labor force gains a year after immigration restrictions are put in place.

CEIR expects business equipment spending to rise by more than 5% next year, supported by favorable fundamentals like past manufacturing investment increases, favorable fiscal policy, ongoing AI-related investments, easing lending standards, and strong economic incentives. While heightened policy uncertainty has historically dampened business equipment spending, as recession fears diminish and help offset some of the uncertainty surrounding trade policies, this drag is anticipated to be modest.

Travel Outlook Amid Political Uncertainty

Predicting future actions from the Trump Administration and Congress is challenging, especially regarding travel impacts; CEIR anticipates declines in visits from China due to negative rhetoric and retaliatory trade restrictions, along with reduced travel from the Middle East due to similar concerns. International travel growth from Canada and Mexico is also expected to decline as tensions rise following new tariffs and stricter immigration enforcement.

“The Q3 2024 CEIR Index reveals a resilient B2B exhibition industry on a continued path to recovery,” said IAEE President and CEO Marsha Flanagan. “While we are still tracking below 2019 levels, we are seeing encouraging signs of growth. CEIR will launch an Organizer Benchmarking Study at the outset of 2025, leveraging additional data sets. This research will provide additional understanding of lagging and leading indicators, to gain deeper insights and drive industry advancement.”

Purchase the 2024 CEIR Index Report here.

Don’t miss any event-related news: Sign up for our weekly e-newsletter HERE, listen to our latest podcast HERE and engage with us on LinkedIn!

Add new comment