CEIR Index: Looming Fiscal Cliff, Global Economic Concerns Slow Down Trade Show Industry Growth in Q3

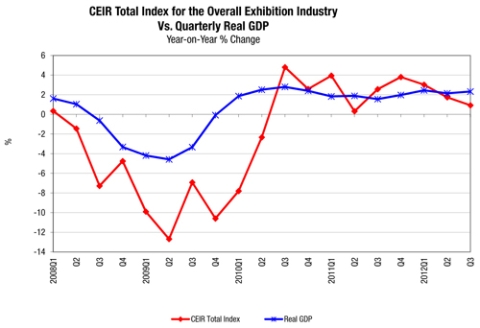

For the ninth quarter in a row, the trade show industry still is growing, according to the Center for Exhibition Industry Research’s latest CEIR Index, albeit at a slower rate in the third quarter of this year, with concerns over not only the looming fiscal cliff, but also the global economy.

The Total Index grew 0.9 percent in the third quarter, after the first quarter grew 3 percent and the second quarter grew 1.7 percent, and companies have become more conservative, waiting to see how everything plays out.

"Concern about the fiscal cliff and the global economy has continued to take a toll in the exhibition industry,” said CEIR's economist Allen Shaw, Ph.D., chief economist for Global Economic Consulting Associates.

He added, “The results show that the exhibition industry continues to grow, but attendees and exhibitors are being cautious due to the uncertainty about the global economy."

The first and second quarters also outpaced the GDP in the U.S. during the same time periods, though the third quarter indicates that growth is slowing.

"The good news is our industry continued the chain of nine consecutive quarters of growth after nine consecutive quarters of negative numbers,” said Doug Ducate, CEIR President and CEO.

He added, “And, while the rate of growth slowed to 0.9 percent after 3.0 percent in the first quarter and 1.7 percent in the second quarter, we are still on a positive growth track.”

Attendance started this year with a bang, snagging a 4.8-percent increase on the CEIR Index in the first quarter, and a 3.3-percent increase the following quarter before flagging to 1.1 percent in the third quarter.

Growth also slowed in net square feet tracked, which was down slightly to 1.3 percent from 1.4 percent in the previous quarter.

Exhibitors showed only a modest gain of 0.9 percent from a year ago, compared with 1.1 percent in the second quarter, and the growth of revenues, which were adjusted for inflation, grew to total $2.62 billion, a slim year-on-year gain of 0.4 percent.

At the CEIR Predict conference, held in September and New York City, Economist John Walker told the crowd of C-level trade show executive, M&A representatives, financiers and suppliers that the U.S. actually was in better shape than most other countries around the world, with a predicted, yet small, more than 2-percent GDP growth rate through next year.

However, he warned that the possible collapse of the Eurozone could have a profound effect on any recovery.

In addition, recent slowdowns in other emerging markets that previously had been growing in leaps and bounds, such as China and Brazil, also could have an impact on the U.S. economy in the near future.

At the event, Walker named several forces that currently were shaping the global economic cycle, including develeraging in an effort to reduce debt, cash hoarding by corporations and high commodity prices, among others.

Even with the uncertainty clouding the Eurozone, though, Walker said the U.S. would continue to see slow growth into 2014.

Add new comment