What’s Trending in U.S. Exhibitions: 5 Takeaways from CEIR’s Q4 2024 Index

The U.S. business-to-business (B2B) exhibition industry continues to rebound, recording the strongest quarter since the pandemic in the fourth quarter (Q4) 2024, according to the recently released Center for Exhibition Industry Research (CEIR) Index that measures exhibition performance for exhibitors, attendance, net square footage, and real revenues.

“Recent results confirm the continued recovery in trade show activity through the end of last year,” said Tourism Economics President Adam Sacks. “This year our baseline outlook remains positive, though we expect economic and policy uncertainty and weaker sentiment among international participants will weigh on business decisions and the ongoing recovery in trade show activity.”

We analyzed the data to present our list of 5 takeaways:

1. Strongest quarter since pandemic. The latest results for Q4 2024 show it represented the strongest level of trade show activity since the onset of the pandemic, with a significant upturn relative to Q3 2024. In Q4, the stronger performance of exhibitor participation and real revenues supported the increase.

2. More than one-third of exhibitions are back to 2019 levels. Among all events in the Index sample, 34.1% have surpassed their pre-pandemic CEIR Total Index performance. This represents an increase from Q4 2023 when 30.4% of events held in that quarter surpassed 2019 results.

3. Overall growth year over year. The Q4 CEIR Total Index – a measure of overall exhibition performance – registered 4.4% below the same period in 2019, marking an improvement over the 10.9% shortfall in Q4 2023.

4. Exhibitors have recovered the most. Among the four components of the Total Index, the exhibitors metric demonstrated the greatest recovery, reaching just 0.1% behind 2019. Real revenues (inflation-adjusted) follows at 1.1% below Q4 2019, net square feet (NSF) reports a shortfall of 3.0% relative to 2019, and attendance has been the slowest to recover from Q4 2019, with a shortfall of 12.9%.

5. Cancellation rate nears zero. The cancellation rate for in-person events remained low at 0.3%, consistent with the previous quarter and significantly lower than 1.4% in Q4 2023.

Related: CEIR Q3 2024 Index Reflects Continued Recovery, Growth of U.S. B2B Exhibitions

Big picture: “The robust performance across all four metrics in Q4 2024 demonstrates the remarkable resilience and ongoing recovery of the B2B exhibition industry,” said IAEE President and CEO Marsha Flanagan. “We are particularly encouraged to see exhibitor participation nearly matching pre-pandemic levels, with revenues close behind. The exhibition industry continues to prove its essential value as a platform for business connections and commerce, even amid economic uncertainties.”

Read the full release and CEIR’s economic outlook here.

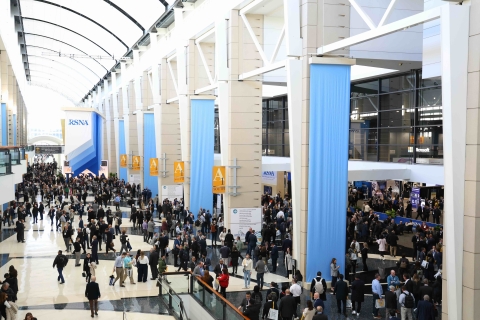

Related: RSNA 2024: WHERE AI, INNOVATION, AND RADIOLOGY CONVERGED—AND ATTENDANCE SOARED

Main image: Held Dec. 1-5, 2024 at Chicago’s McCormick Place, RSNA was one of the U.S. exhibitions held in Q4 2024. Photo: RSNA

Add new comment